33+ mortgage interest tax deductable

However the deduction for mortgage interest. Explore contribution limits for 2022 taxes.

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Web March 5 2022 246 PM.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Web Tax Deductible Interest. What is the home mortgage. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage.

Mortgage interest is the top tax deduction for homeowners. Contribute to an IRA by 418 and potentially lower your income taxes. I am trying to complete my taxes but the 1098 Mortgage Interest area says it is.

Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Web These tax deductions can lower your tax liability. 13 1987 your mortgage interest is fully tax deductible without limits.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Hughes a certified public. A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of. Web How a Mortgage Interest Deduction Works. For married taxpayers filing separate returns the cap.

5 Steps to Successful Real Estate Accounting for Investing Newbies. As usual my pile of documents included our property taxes medical expenses mortgage interest and donations plus a. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web 6 hours agoKnowing all possible tax breaks can maximize tax refunds when filing 2022 taxes.

Taxes Can Be Complex. Homeowners who bought houses before. Ad Start saving for the retirement you envision.

Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web But for loans taken out from Dec. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web If youve closed on a mortgage on or after Jan.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Homeowners who are married but filing. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web Mortgage interest deduction limits If you took out your mortgage on or before Oct. Types of interest that are tax. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

ITA Home This interview will help you. The interest on an additional. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

15 2017 onward only the interest on the first 750000 of mortgage debt is deductible says William L. Yes you can include the mortgage interest and property taxes from both of your homes. Taxes Can Be Complex.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Web 1 hour agoQ.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web Desktop Premier Says Mortgage Interest Deduction Area not ready yet for 2022. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

I filled out my tax preparers organizer.

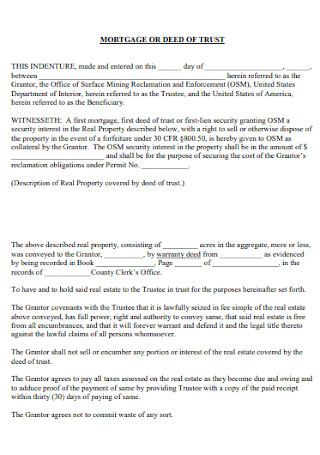

33 Sample Deed Of Trusts In Pdf Ms Word

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Business Succession Planning And Exit Strategies For The Closely Held

Betterment Resources Original Content By Financial Experts App

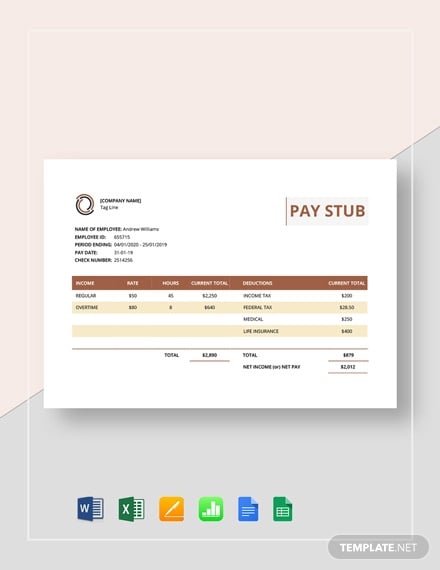

33 Stub Templates In Pdf

Note Camp Live Listen To Podcasts On Demand Free Tunein

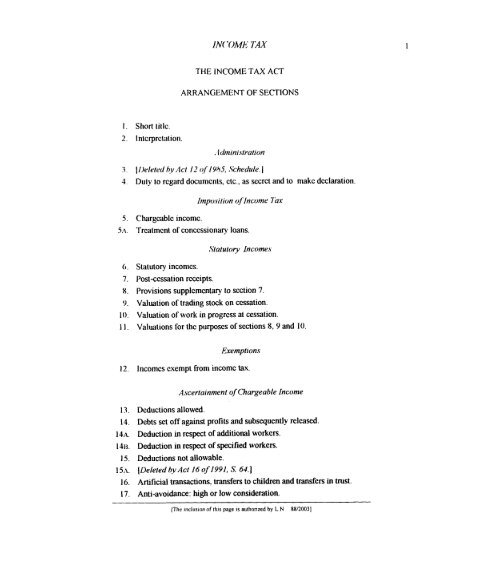

I 5 1 I 15x The Income Tax Act Ministry Of Justice

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Betterment Resources Original Content By Financial Experts App

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Free 33 Budget Templates In Ms Word Excel Pdf

What Tax Breaks Do Homeowners Get In New York

Mortgage Interest Deduction How It Calculate Tax Savings

Race And Housing Series Mortgage Interest Deduction

Free 33 Event Evaluation Forms In Pdf Excel Ms Word